The Future of Housing in California

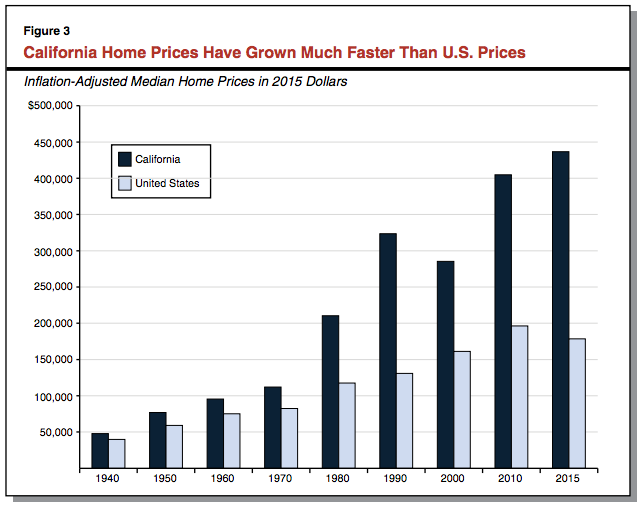

On March 17 the Legislative Analyst’s Office of California, the non-partisan state research agency, released a comprehensive report on the high cost of housing in the State. The report documents a 40-year trend in which the costs of housing within California rose at near four times the national average, and highlights the impact that local “no growth” policies have had in limiting private development within the coastal areas.

As of last year the median home price in California was $437,000, far outpacing the national average of $179,000. Average monthly rents are 50 percent higher on average than those in the rest of the country. There is also a wide disparity of housing costs within the state, with coastal communities having significantly higher housing costs overall. In San Francisco, the state’s most expensive metropolitan area, the average monthly rent is six times higher than that of Bakersfield, the state’s least expensive metro area.

The state’s high cost of housing has a significant impact on its economy, forcing lower wage workers to spend a greater portion of their monthly income on rent, live in more crowded living environments, and commute an average of 10 percent further than the national average. This also limits economic mobility through higher labor and property costs, indirectly forcing the state’s laborers and companies into making sub-optimal economic decisions, and in some cases even leaving the state.

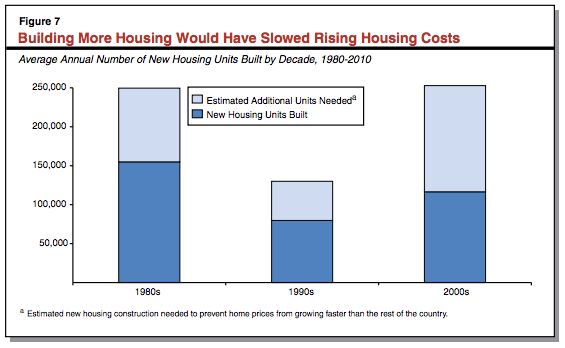

The report lays bare what it believes to be the primary contributing factor to California’s high housing costs, that is insufficient development in the State’s coastal areas to meet the demand for housing. California’s largest metro areas are building new housing at a rate less than half of comparable metro areas in other parts of the country. This new development is also less dense than in other areas, meaning that California is developing fewer livable units per parcel of land, being on average 40 percent less dense than other metro areas in the United States. The graphs below compare the rate of new housing development between the national average, the state average, and the average of the California coast.

Building costs are also higher in California, including the cost of labor, and government fees and compliance costs. According to a national survey cited in the report, California’s government fees on new development are 260 percent higher than the national average. The added cost per unit from government fees alone is roughly $22,000, compared to the U.S. average of $6,000.

The long time policy approach for developing denser, lower cost housing in many of the State’s communities has been direct financing through matching state and federal assistance, as well as tax credits. However, these programs combined have resulted in the development of 7,000 new units annually, roughly 5 percent of the total units constructed, a paltry sum compared to what’s needed given that the report estimates the state would have to build an additional 100,000 units a year, for ten years, on top of what it’s currently building, in order to fully address the affordability crisis.

The report goes on to say that the reason why cities and counties simply don’t build more housing is primarily due to public resistance. The state’s environmental review process, outlined under the California Environmental Quality Act (CEQA), is consistently used to halt or delay projects on environmental grounds, and provides significant opportunity for legal resistance even past the point of legislative approval. Furthermore, most local municipalities in the state have significantly burdensome project approval processes, usually involving approval from multiple departments and public commissions, forcing private developers into uncertain market conditions and costing them added time. Two thirds of California coastal communities have even adopted specific growth control measures, which vary from placing new restrictions on certain types of development, to direct caps on the number of units that can be built.

The report concludes by providing a series of broad recommendations that could be considered by the Legislature in addressing the housing crisis. These include building more housing within the coastal areas by creating specific goals that local governments would have to meet, amending CEQA to make it harder to appeal projects, exploring new financing options that target those earning lower incomes, and shifting some control over land use decisions from the local level to the state level. However, the report fails to provide much specificity in terms of prescribing legislation.

Posted below are some examples of specific legislation that could be adopted to help facilitate the development of more housing within the state:

Transfer Tax

The State of California currently collects a transfer tax on the sale of real property assets equivalent to one half of one percent of the sale value. This tax is collected through cities and counties. Chartered cities are allowed to increase this tax rate as a means of generating local revenue, but non-chartered cities, and all counties, were stripped of this ability under Proposition 13. However, the State Legislature could pass a law allowing for all cities and counties to set their own transfer tax rates as a means of generating more local revenue. This revenue could then be used to in conjunction with existing affordable housing programs to fund more workforce housing. Should California allow cities and counties to adopt their own transfer taxes? Vote and comment below:

|

Pass Legislation that Allows all Cities and Counties to Levy a “Transfer Tax” Whenever a Property Changes OwnershipUnder the California tax code whenever a parcel property changes ownership within the State, a tax equal to one half of one percent is taken from the sale value of the property. |

Amend CEQA to Exempt Housing Development Projects with Local Public Financing

Under the California Environmental Quality Act, lead agencies with jurisdiction over a particular development project are charged with preparing a negative declaration, mitigated negative declaration, or environmental impact report (EIR), unless exempted. A possible exemption for CEQA could include all projects where the lead agency is offering partial financial support. This would apply to all affordable housing projects that are partially sponsoring by local programs, making it easier to locate and develop these types of projects. Environmental Impact Declarations and Reports are often extremely burdensome on new housing projects, and are easy to appeal with frivolous lawsuits whose only intention is to delay a project. This would ensure that local agencies are still held accountable for their participation in a given project, while still making it easier to move forward. Should the California legislature adopt an exemption for CEQA guidelines for projects partially subsidized with public money? Vote and comment below.

|

Exempt Housing Development Projects with Partial Public Financing from CEQA GuidelinesUnder the California Environmental Quality Act, lead agencies with jurisdiction over a particular development project are charged with preparing a negative declaration, mitigated negative declaration, or environmental impact report (EIR), unless exempted. |

Mandate that Housing Element Updates Address Gaps in Affordability

Every 4 years the State of California requires every city and county within the state to update their Housing Elements, which outline the total number of new units that need to be built within a given area to keep up with population growth. Housing Elements also offer the opportunity to rezone opportunity sites in order to facilitate this additional growth. The State could also require that local municipalities be required to meet certain thresholds in terms of reducing the overall affordability gap through the development of new housing. One such rule could be that all Housing Elements include a plan to build out enough units so that at least 20 percent of the population could afford to rent a 1 bedroom apartment, spending only one third of their gross monthly earnings, while earning the Area Median Income (AMI). This would greatly encourage areas that currently aren’t in compliance to rezone a significantly portion of their parcels to meet this goal. For instance, in Santa Cruz County, only 9 percent of the population pays one third or less of their income in rent, meaning that the County would have to rezone quite a substantial amount of land to allow for enough new housing to put market pressure on the existing rental stock to reduce their rents. Vote and comment on this proposal below.

|

Require Municipalities to Plan to Build Enough Units so that 20 Percent of their Population can Afford to Rent a 1 Bedroom Apartment While Earning the Area Median Income.Every city and county within the State of California is required to update their Housing Elements every 4 years, planning for enough new development to keep pace with population growth. |

1 Comment

[…] on this blog, with many articles being written about potential new development policies, on new state policies, on homelessness, and other potential reforms. However, there is one measure that recently […]